FG, SEC, AMEDA others seek accelerated infrastructure to boost economy

- Economy

- No Comment

- 229

FG, SEC, AMEDA, others seek accelerated infrastructure to boost economy

…Collaboration Key to Financial Market Growth and Economic Transformation

The Federal Government, Securities and Exchange Commission (SEC), Africa and Middle East Depositories Associations (AMEDA), and other financial market stakeholders have called for accelerated collaboration to enhance capital market infrastructure and drive economic growth.

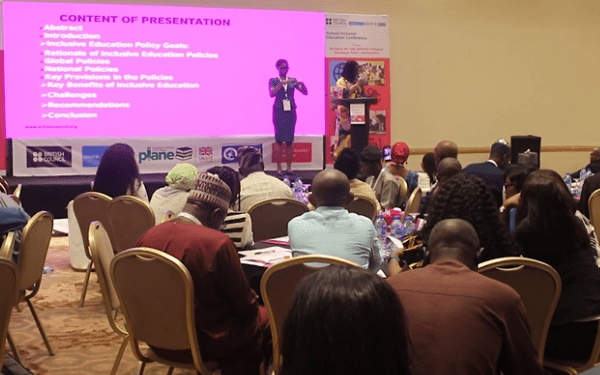

This call was made during the 2025 AMEDA Conference hosted by the Central Securities Clearing System (CSCS) Plc in Lagos.

Themed “Shaping the Future: Financial Markets and Infrastructure as Catalysts for Transforming Economies,” the conference attracted key figures from both public and private sectors, including the Minister of Transport (represented by Dr. Jumoke Oduwole), the Minister of Trade and Investment (represented by Special Adviser John Uwajumogu), NGX Group Chairman Dr. Umaru Kwairanga, NGX Group CEO Temi Popoola, and the AMEDA executive team.

Vice President Senator Kashim Shettima, represented by Dr. Tope Fasua, Special Adviser to the President on Economic Affairs, emphasized the urgent need to reposition financial systems as engines of growth in Africa and the Middle East.

He highlighted the impact of technological shifts, innovation, and digital disruption on financial markets.

“We need market infrastructures—depositories, clearing and payment systems, and digital platforms—that sustain trust, enable transparency, and provide the liquidity our markets require.

“These institutions, often operating behind the scenes, are vital to our economies,” Shettima noted.

He reaffirmed the administration’s commitment to strengthening Nigeria’s financial infrastructure through regulatory reforms, capital market development strategies, and robust public-private collaboration. These efforts include broadening capital market participation, improving MSME financing, and leveraging instruments like green bonds, Sukuk, and social bonds.

In his goodwill message, SEC Director-General Emomotimi Agama, represented by Executive Commissioner Bola Ajomale, stated: “We live in an era of accelerated transformation. Financial markets today are active agents of national development, regional integration, and global competitiveness.”

He added that the recently enacted Investments and Securities Act (ISA) 2025, which repealed the 2007 Act, represents a significant milestone. The new law expands SEC’s regulatory powers, enhances investor protection, and introduces frameworks for digital assets and derivatives, aligning Nigeria with global standards.

CSCS Managing Director and AMEDA Vice Chairman, Haruna Jalo-Waziri, in his welcome address, urged stakeholders to view financial market infrastructure not as silent enablers, but as proactive drivers of economic transformation.

“As economies navigate rapid digital shifts, demographic changes, and geopolitical tensions, we must build resilient markets, ensure inclusive digital access, and foster cross-border integration,” he said.

Lagos State Governor Babajide Sanwo-Olu, represented by Commissioner for Economic Planning and Budget, Mosopefolu George, reiterated Lagos’ commitment to infrastructure investment through the state’s “2025 Budget of Sustainability.”

“Financial markets are vital engines of economic change, but this cannot be achieved without robust infrastructure that connects people and ideas,” he said.

Keynote speaker and Chairman of Access Holdings Plc, Aigboje Aig-Imoukhuede, commended CSCS for hosting the event. He urged AMEDA members to strengthen collaboration, share best practices, and drive innovation.

“As AMEDA members, you must unite to build strong, resilient markets. Your collective strength can transform Africa and the Middle East into a powerful economic bloc,” he stated.